Are you on the lookout for a credit card that aligns perfectly with your savvy spending habits? The Blue Cash Everyday® Card from American Express is your ticket to a world of rewards, perfectly tailored for the savvy spender. Let’s dive into what makes this card an unbeatable choice.

A Warm Welcome with a Hefty Reward

$200 Statement Credit with our exclusive referral offer: Kick off your journey with the American Express Blue Cash Everyday Card by earning a generous $200 back in the form of a statement credit. All it takes is spending $2,000 on your new card within the first 6 months. Think about it – your regular shopping, bills, and subscriptions can lead to a substantial reward! This offer is only available when applying for the card using the link on this page.

A No-Fee Haven of Rewards

No Annual Fee: Say goodbye to annual fees! The Blue Cash Everyday® Card offers a world of benefits without any annual fee, aligning with your frugal and smart spending principles.

Unparalleled Cashback Benefits

3% Cash Back on Groceries: Transform your grocery runs into a lucrative venture. With 3% cash back on up to $6,000 per year at U.S. supermarkets, you could earn up to $180 back annually just on groceries!

3% Cash Back on U.S. Online Retail Purchases: Maximize your savings with the Blue Cash Everyday® Card, offering 3% cash back on U.S. online retail purchases. Enjoy rewards from a wide array of popular online stores, including Amazon, Walmart.com, Target.com, Best Buy, Home Depot, eBay, Etsy, Wayfair, Macy’s Online, and Nike.com. This benefit makes online shopping across different categories, from electronics to fashion, more rewarding and cost-effective.

3% Cash Back on Transit and Gas: The American Express Blue Cash Everyday® Card makes your daily commute and road trips more rewarding. Earn 3% back on transit, including everything from taxis and rideshares to parking and tolls. And don’t forget about the gas stations! Combine this with the Upside app for even more savings at the pump.

Tailor-Made for Entertainment Enthusiasts

$84 Disney Bundle Credit: Indulge in your love for Disney, Hulu, and ESPN with an annual credit of up to $84. Spend $9.99+ each month on the Disney Bundle, and you’ll get $7 back monthly. It’s like getting the Disney Bundle almost free!

Exclusive Home Chef Credit

$180/year Home Chef Credit: Elevate your dining with up to $180/year ($15/monthly) in Home Chef credits. Combine this with Home Chef promo codes for even more savings on delicious, easy-to-prepare meals.

Personalized In-App Offers

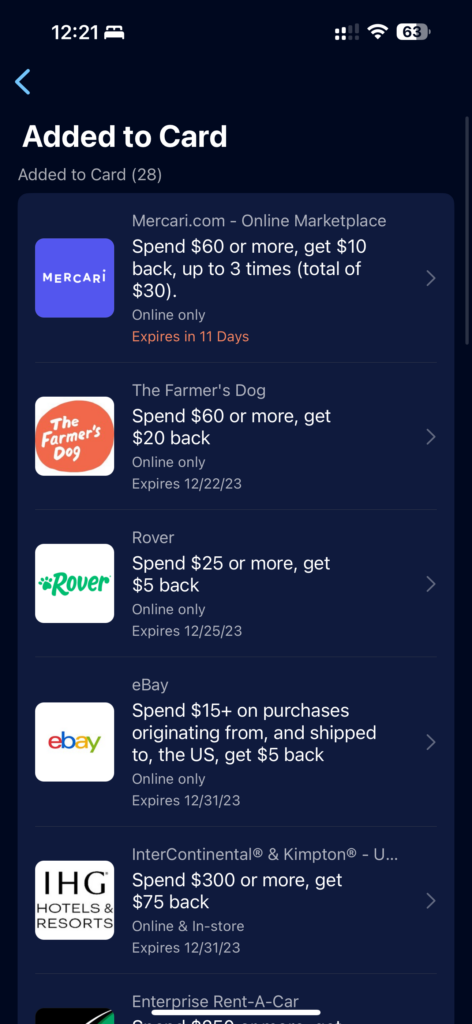

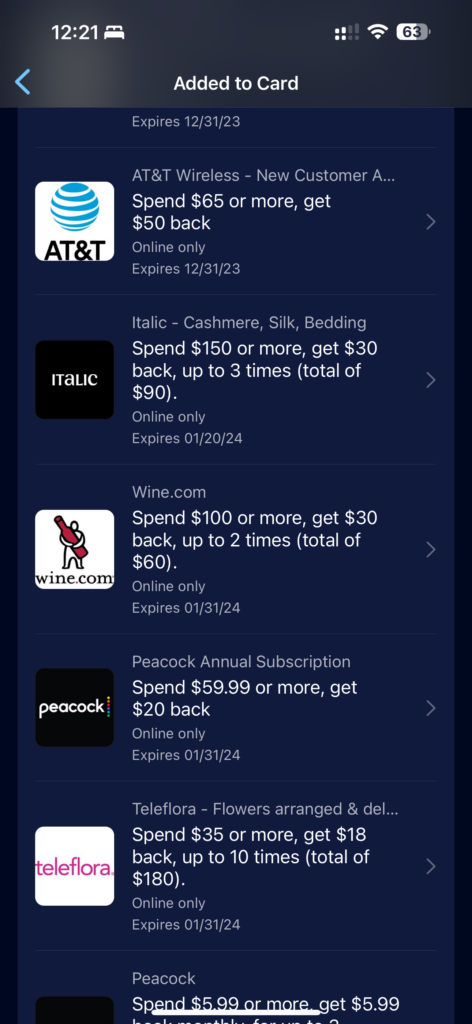

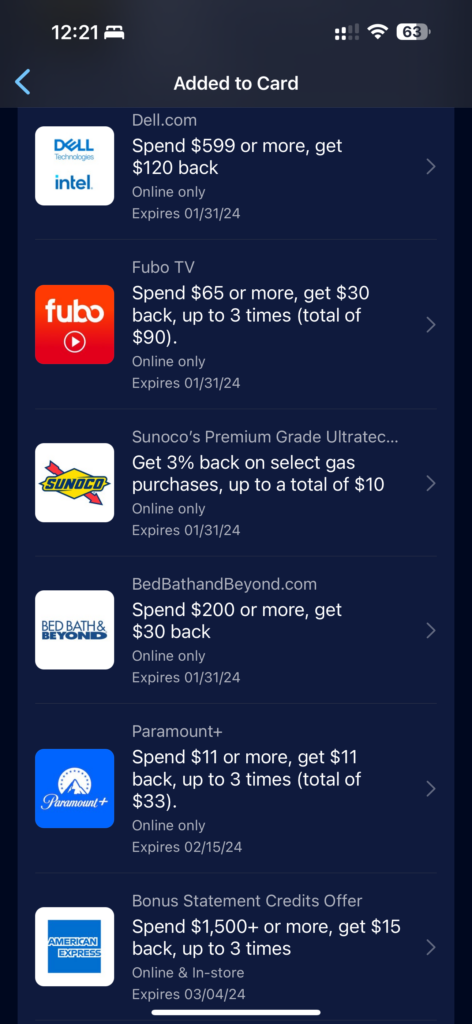

More Savings with Personalized Offers: Enjoy additional savings with personalized in-app offers, tailored to your spending habits and preferences, ensuring you get the most out of every purchase. An example of the offers available in app include:

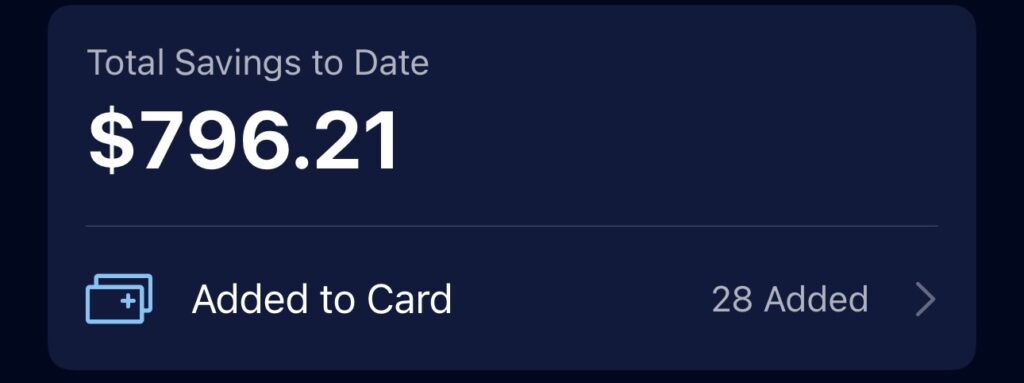

We have saved ~ $800 with these in-app offers in the first year of the card membership…..

Generous Introductory Offers

0% Intro APR: Enjoy a 0% intro APR on purchases and balance transfers for the first 15 months from the date of account opening. After that, a variable APR of 19.24% to 29.99% applies.

$0 Intro Plan It® Fees: Experience the flexibility of buying now and paying later with $0 intro Plan It fees on plans created during the first 15 months. Subsequent plans will have a fixed monthly fee, making large purchases more manageable.

The FrugalFella Seal of Approval

Why Choose This Card?: The Blue Cash Everyday® Card is more than just a credit card; it’s a lifestyle choice for those who value efficiency and savings. With no annual fee, lucrative cashback options, and introductory benefits, this card empowers you to make the most of your everyday spending.

A Perfect Match for Everyday Spenders: Whether it’s groceries, online shopping, or fueling up, this card transforms every transaction into a rewarding experience. It’s designed for the practical spender who wants to earn big without any hidden costs.

Conclusion

Embrace the simplicity and efficiency of the Blue Cash Everyday® Card from American Express. Apply today and start enjoying a wealth of benefits designed to amplify your savings and enrich your everyday spending. With zero annual fees and a host of cashback opportunities, it’s the card that keeps on giving!

Overall, when combining all of the offers, cashback and discounts, the Blue Cash Everyday® Card from American Express could save up to $1500/year on the family budget. Money that can be then used for investments and achieving financial freedom!

Leave a Reply

You must be logged in to post a comment.