Imagine a credit card that goes beyond the usual perks, one that quietly offers a significant monthly reward – up to $200 in free gift cards. This isn’t a premium card with high fees; it’s a no-fee card, accessible to many but known to few for its unique advantage. In the realm of credit cards, hidden gems abound, but few shine as brightly as the Citi Simplicity Card. This no-annual-fee card is a key to unlocking a treasure trove of benefits, including an astonishing $150-$200 worth of free gift cards every month.

The Citi Simplicity Card: A Deeper Look

The Citi Simplicity Card is renowned for its straightforward, user-friendly approach. It stands out in the credit card market for its no-late-fees policy and an attractive introductory APR offer.

Some key features of the Citi Simplicity Card include:

- No annual fee.

- A lengthy introductory APR period on balance transfers and purchases, which can vary but has been known to be as long as 21 months for balance transfers and 12 months for purchases, after which a variable APR applies based on creditworthiness.

- No late fees or penalty rate.

- Flexible payment due date, allowing you to choose when to pay your bill within the month.

- $0 liability on unauthorized charges, providing protection against fraud.

- The card is a Mastercard, which is widely accepted globally.

It’s important to note that while the card offers these benefits, it does not provide any rewards, such as cash back or points, and there’s no sign-up bonus offer.

However, the card’s most remarkable feature, often overlooked, is its access to the exclusive Citi Easy Deals program.

A Special Savings Program: Citi Easy Deals

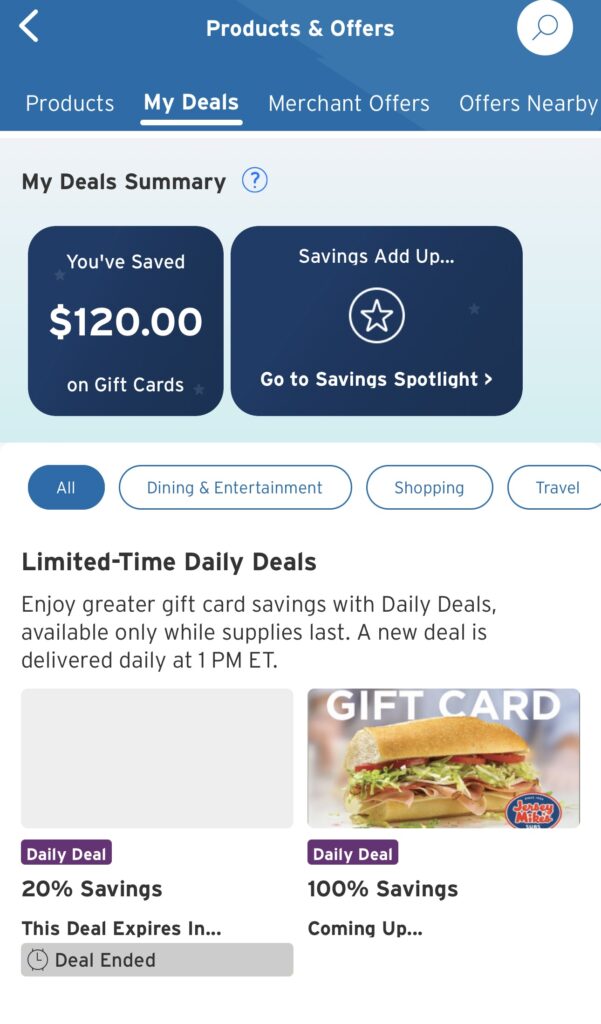

Citi offers a program known as Citi Easy Deals, which is a tiered savings program available to holders of specific Citi credit cards like the Citi Simplicity® Card and Citi® Diamond Preferred® Card. The program has been recently rebranded to “My Deals” for Citi cardmembers and is accessible through the Citi Mobile App and Citi Online.

Citi Easy Deals operates on three tiers:

- Base Tier: This tier is available to all qualifying cardholders who enroll in Citi Easy Deals and offers access to local deals from restaurants and retailers.

- Enhanced Tier: When you spend $100 on purchases in a calendar year, you move into the Enhanced Tier, which includes everything in the Base Tier plus savings on gift cards and magazine subscriptions.

- Plus Tier: Achievable by spending at least $500 in a calendar year, this tier unlocks the full potential of Citi Easy Deals, including savings on travel, merchandise, and Daily Deals.

The program is not a card-linked offer program; rather, it allows cardholders to unlock savings immediately, such as discounts on dining, merchandise, and travel purchases. The program offers a 5-10% discount on the purchase of Gift Cards from more than 100 retailers (currently 63 retailers in Dining and Entertainment, 57 retailers in Shopping and 10 retailers in the Travel category), meaning you can always save 5 or 10% on many of your purchases (which most of the time can be stacked with CashBack from websites like TopCashBack). Once eligible, you can register for Citi Easy Deals by inputting your details on the registration page and creating a username and password. However, the true gold mine here is in the Daily Deals section.

The Secret to Daily Gift Card Savings

Every day at 1 PM ET, Citi Easy Deals unveils new offers, often including heavily discounted or even free gift cards. The free gift cards are usually valued at $5, while the 50% OFF are valued $10. These can range from popular eateries like Panera Bread and Subway to retail giants like CVS, Starbucks, and Dunkin’ Donuts. On some days (usually once or twice a week), you will find gift cards for Target, Amazon, and Walmart at 20-40% off (valued at $30 to $50).

While $5-$10 gift cards may last for a few hours, the highly coveted ones for stores like Walmart, Target, and Amazon, often valued at $50, can disappear within the first 10 minutes.

Strategies for Maximizing Benefits

The secret to making the most of these deals is promptness and consistency. By setting a daily calendar reminder for 1 PM ET and quickly accessing the Citi App, you can be among the first to grab these sought-after deals. Regular participation can lead to an impressive haul of about $150-$200 in free gift cards value each month!

While it is easy to use most of these gift cards ourselves to unlock the maximum value, for brands we were not interested in, we were still able to sell the $10 Gift Cards on CardCash, a website where users can buy and sell gift cards. The selling process is quite straightforward: select the brand of the gift card you want to sell, get the estimated value and sell the Gift Card to the website (payout ratios are usually between 70 to 85%, depending on the popularity of the Gift Card brand). For the $5 gift cards, we were able to exchange them for either other Gift Cards or Money on Reddit.

Conclusion: A Financial Tool That Pays Dividends

The Citi Simplicity Card breaks the stereotype of no-fee credit cards. It offers not just financial convenience but also a path to significant monthly savings through the Citi Easy Deals program. For those keen on maximizing their financial tools, this card is a hidden treasure in plain sight.

Leave a Reply

You must be logged in to post a comment.