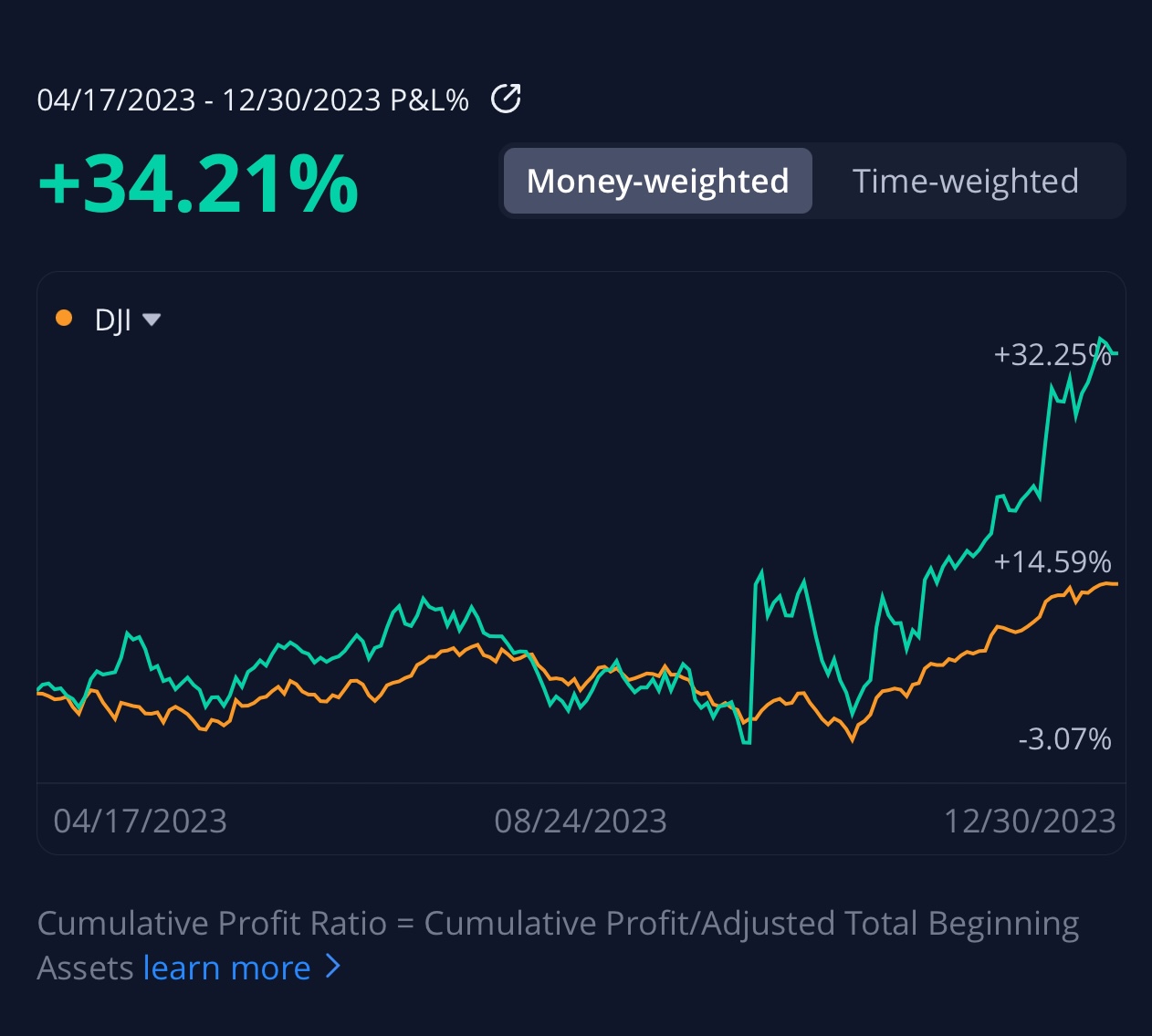

As we close our first financial year, it’s time to reflect on the remarkable achievements of the Road To $1 Million portfolio. With a cumulative profit ratio of 34.21%, we’ve not only outpaced the market but have significantly eclipsed the Dow Jones’ returns of 15.28%. So, what does a 34.21% cumulative profit ratio really mean for us, and more importantly, for our readers following the investment journey?

Understanding Cumulative Profit Ratio vs Total Returns

In the world of investing, metrics are the compasses that guide our decisions and gauge our success. Among these, the cumulative profit ratio stands out as a nuanced and insightful metric. This ratio offers deeper insights into an investment portfolio’s performance compared to more traditional metrics like total returns.

For context, the total returns of the Road To $1 Million portfolio, which are prominently displayed at the top of our website and updated biweekly, currently stand at 7.2%. This figure represents the overall profit of the portfolio – a straightforward calculation of how much the portfolio’s value has increased or decreased over a period.

However, the cumulative profit ratio doesn’t just look at how much the portfolio has grown; it considers the timing and scale of asset inflows and outflows. Imagine this scenario: if significant investments are made just before a strong market rally, the impact on the portfolio’s growth would be considerably different than if the same investments were made after the rally. The cumulative profit ratio captures this nuance by weighing profits against the specific times and amounts of investments. This makes it a more accurate reflection of the actual profits earned, taking into account the strategic timing and magnitude of each investment. This is essential to account for in an investment strategy (such as the one we employ for the Road To $1 Million Portfolio) that is based on weekly investments. The money invested more recently has not had the time to grow as the money invested at the beginning of the portfolio, thereby decreasing the total returns.

In simpler terms, think of total returns as the final score of a game, while the cumulative profit ratio is more like an in-depth analysis of how each play contributed to that score. The total return tells you how much you’ve made in total, but the cumulative profit ratio reveals the effectiveness and timing of your investment decisions.

The Significance of Our Strategy

At the heart of the Road To $1 Million success is our disciplined weekly investment approach. Each week, we contribute a predetermined amount to our portfolio, ensuring a steady growth trajectory. But it’s not just about how much we invest, it’s also about where we invest. Our weekly asset allocation is selected based on their current value compared to their fair price and their potential for dividend yield and growth. This tactical allocation maximizes returns while minimizing risks.

The Power of Dividend Compounding Without DRIP

One of the key differentiators of our strategy is how we handle dividends. Instead of automatically reinvesting dividends through Dividend Reinvestment Plans (DRIPs), we receive them as cash in our brokerage accounts. This cash then becomes part of the following week’s investment. Let’s say our standard weekly investment is $500. In a given week, imagine the portfolio earns $40 in dividends. Rather than reinvesting these dividends directly back into the market (as is common in many Dividend Reinvestment Plans or DRIPs), we receive them as cash. This cash then becomes part of the following week’s investment. For instance, if our weekly target is $500 and we receive $40 in dividends, our actual cash investment for the next week is $460.

This approach has a subtle but powerful impact on the total returns over time.

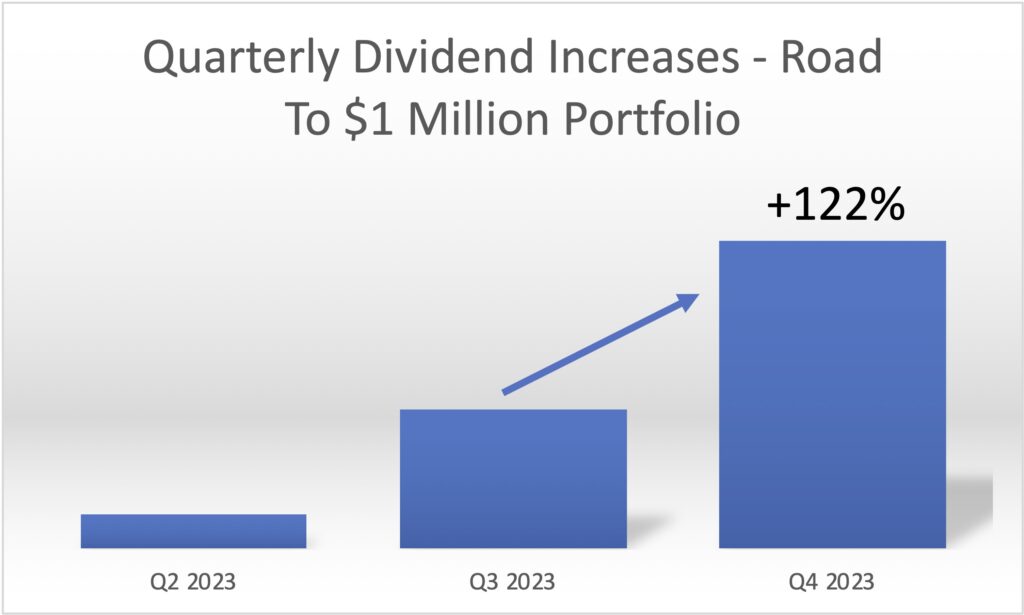

As the dividends grow, they represent an increasing proportion of the total investment amount each week. This means that even if market conditions remain static, the total returns of the portfolio will inherently grow, thanks to the compounded impact of the reinvested dividends.

In essence, our strategy leverages the power of dividend compounding. It’s akin to a snowball effect; as the portfolio grows, it generates more dividends, which in turn are reinvested to decrease the cash amount that it is needed each week. This method offers us flexibility and allows to capitalize on market opportunities more effectively, as we can save cash that we can deploy to invest during bear market conditions (at least until we decide to increase the weekly investment allocation) . Overall, this cycle plays a crucial role in the gradual but consistent increase of our total returns, underscoring the effectiveness of our investment approach.

Join The Road To $1 Million Investment Journey

We believe that everyone deserves a chance at financial freedom, and TheFrugalFella.com is committed to making this a reality. Our Road to $1 Million portfolio offers investment allocations tailored for every budget, ranging from $100 to $500 per week or month. Whether you’re a seasoned investor or just starting out, our approach is designed to maximize returns and foster long-term growth. Moreover, we are expanding the tools available to our users. Starting today, our private Twitter/X Feed is live, where our readers will be able to receive real-time alerts about portfolio movements and news! Request access today!

Conclusion

As we celebrate our success this year, it’s important to remember that the journey to financial freedom is a marathon, not a sprint. Our cumulative profit ratio of 34.21% is a testament to the effectiveness of our strategy, and we’re excited to see what the future holds!

Leave a Reply

You must be logged in to post a comment.