Creating a personal budget is a fundamental step towards achieving financial stability and success. This detailed guide is dedicated to helping you understand and master the art of budgeting. Whether you are a budgeting novice or looking to refine your existing financial plan, this step-by-step guide will walk you through how to create a budget that aligns with your financial goals and lifestyle.

Step 1: Assessing Your Financial Situation

The first step in creating a budget is to get a clear picture of your financial situation. This involves gathering all your financial statements, including bank statements, investment accounts, credit card bills, and any other documents that reflect your income and expenses. This comprehensive assessment is crucial as it lays the foundation for your budgeting process.

Step 2: Calculating Your Income

The next step is to determine your total income. This should include all sources such as salaries, bonuses, rental income, and any side hustles. If your income is variable, calculate an average based on the past few months. Remember, we’re focusing on net income – the amount you receive after taxes and other deductions.

Step 3: Identifying and Categorizing Expenses

Now, turn your attention to expenses. There are two types of expenses: fixed and variable.

- Fixed expenses are those that do not change from month to month. These include rent or mortgage payments, car payments, insurance premiums, and any other regular, predictable costs.

- Variable expenses, on the other hand, fluctuate. They include groceries, dining out, entertainment, gasoline, and similar categories.

It’s crucial to get a clear understanding of both to create a realistic budget.

Step 4: Estimating Monthly Costs

This step involves reviewing your past spending to estimate how much you spend in each expense category. Use your gathered financial documents to review the past three to six months of spending. This historical analysis helps in accurately predicting future spending patterns. Tools like Mint or You Need A Budget (YNAB) can be invaluable here, as they automatically categorize and track your spending.

Step 5: Creating Your Budget

With your income and expenses laid out, it’s time to create the budget. There are various methods and tools for this, from simple spreadsheet templates to sophisticated budgeting apps. The key is to allocate every dollar of your income to a specific expense or savings category, ensuring that your total expenses do not exceed your income.

Step 6: Adjusting and Optimizing Your Budget

Your first draft budget is just that – a draft. It will need adjustments and refinements. As you live with your budget, you’ll discover areas that need tweaking. This could be reducing spending in one category or increasing it in another. The goal is to find a balance that works for your lifestyle and financial goals.

Step 7: Regular Monitoring and Review

A budget is not a set-it-and-forget-it tool. Regular monitoring is essential. Set aside time each month to review your budget and track your progress. This regular check-in ensures you stay on track and make adjustments as needed, especially when facing financial changes like a new job, a raise, or unexpected expenses.

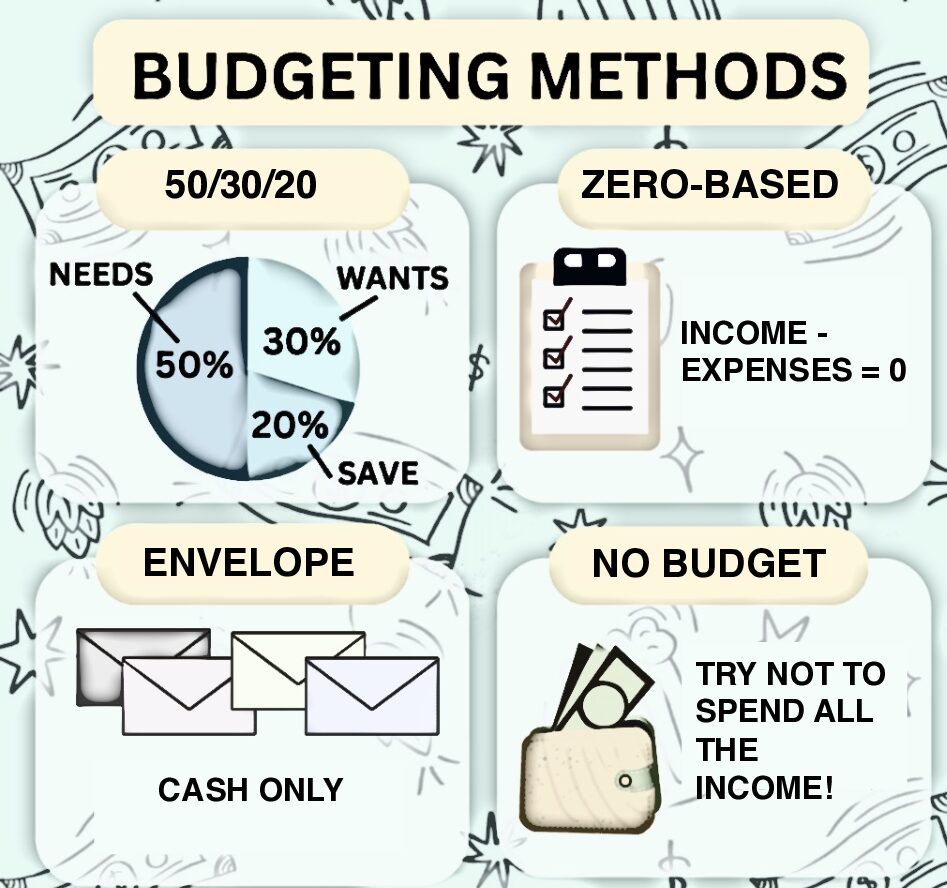

Understanding Budget Variations

There are several budgeting methods, such as the zero-based budget, the 50/30/20 rule, or the envelope system. Experiment with different methods to find the one that best suits your financial situation and goals.

1. Zero-Based Budgeting

What It Is: Zero-based budgeting is a method where your income minus your expenses equals zero. This means you allocate every dollar of your income to specific expenses, savings, and debt repayment.

Step-by-Step Guide:

a. Calculate Total Monthly Income: Start by determining your total income for the month. This should include all sources, like salaries, bonuses, and any side hustles.

b. List All Monthly Expenses: Next, list all your expected expenses for the month. This includes fixed expenses (like rent and insurance), variable expenses (like groceries and entertainment), debt payments, and savings contributions.

c. Assign Every Dollar a Job: Allocate each dollar of your income to an expense category. The aim is to ensure that your income minus your expenses equals zero.

d. Monitor and Adjust: Throughout the month, track your spending. If you spend less in one category, reallocate the excess to another category or savings.

e. Review at Month-End: At the end of the month, review your spending and adjust the next month’s budget based on your actual expenses.

2. The 50/30/20 Rule

What It Is: The 50/30/20 rule is a simplified budgeting method where you allocate your income into three categories: 50% for needs, 30% for wants, and 20% for savings or debt repayment.

Step-by-Step Guide:

a. Calculate Your After-Tax Income: Determine your take-home pay after taxes.

b. Categorize Your Expenses into Three Groups:

- Needs (50%): These are essential expenses such as rent, utilities, groceries, and transportation.

- Wants (30%): This category includes non-essential expenses like dining out, hobbies, and entertainment.

- Savings/Debts (20%): Allocate this portion to savings, investments, and debt repayments.

c. Adjust as Necessary: Depending on your financial goals and situation, you may need to adjust these percentages. For example, if you have high debt, you might allocate more to the savings/debts category.

3. The Envelope System

What It Is: The envelope system is a budgeting method where you use cash for most spending categories. Each category has an envelope with a predetermined amount of cash.

Step-by-Step Guide:

a. Determine Your Spending Categories: Identify categories where you typically use cash, like groceries, dining out, entertainment, etc.

b. Allocate Budget to Each Envelope: After receiving your income, fill each envelope with the budgeted amount of cash for its category.

c. Spend Only What’s in the Envelope: Use only the cash from the appropriate envelope for expenses in that category. Once the cash is gone, you can’t spend more in that category until you refill the envelope in the next budget cycle.

d. Monitor and Adjust if Necessary: If you find that you consistently run out of cash in a particular envelope, reassess your budget allocation for the next month.

Choosing the Right Method

Each of these methods has its strengths and can be effective depending on your financial situation and goals. The Zero-Based Budgeting method is great for meticulous financial management, the 50/30/20 rule offers a more balanced and simplified approach, while the Envelope System is ideal for those who prefer to use cash and need a tangible way to control spending.

Experimenting with these methods will help you find the best fit for your lifestyle and financial objectives.

Common Budgeting Challenges and Solutions

Budgeting isn’t always smooth sailing. You may encounter challenges like fluctuating income, unexpected expenses, or difficulties in tracking spending. These challenges can be overcome with adjustments to your budget, using tools for better tracking, or perhaps consulting with a financial advisor for more personalized guidance.

The Role of Emergency Funds and Savings

An essential component of a successful budget is saving for an emergency fund and future financial goals. This ensures you’re prepared for unexpected expenses and are working towards long-term financial security.

Conclusion: The Path to Financial Freedom

Creating and sticking to a budget may seem daunting, but it’s a crucial step towards financial freedom. By following this detailed, step-by-step guide, you’ll be well on your way to mastering your finances. Remember, a budget is a living document that evolves with your financial journey. Stay committed, be flexible, and watch as your financial stability and confidence grow.

Leave a Reply

You must be logged in to post a comment.